so-sure

- Title: Hands-On CTO

- Website: https://www.wearesosure.com/

Company

so-sure is a startup MGA that offers mobile phone insurance directly to consumers

Team

I was the first technical hire at so-sure, where I developed the majority of the backend systems and API, along with all of the infrastructure. I built the technical team, hiring two native app developers, one front-end developer, and two backend developers. I collaborated closely with the Managing Director, Head of Product, and Head of Marketing, as well as the underwriter and claims team.

Challenge

My time at so-sure encompassed several stages, with some notable projects outlined below:

App MVP: Initially, my focus at so-sure was on creating the MVP. Together with the product owner, we adopted an app-first approach. I hired the app developers and built the backend for the initial product, including its architecture, infrastructure, API, and admin portal. Additionally, I sourced and integrated the payment provider, as well as the anti-fraud and device-checking services. I collaborated extensively with our underwriter and claim handlers to define and implement the data exchange and to conduct integration testing.

Product Market Fit: After the MVP launch, we quickly realized that a mobile-first approach was not effective for customer acquisition. To address this, we implemented a web-based purchase flow. During this period, we focused on growth by implementing Mixpanel tracking and A/B testing to rapidly iterate on new ideas.

Product & Policy Alignment: Working with the underwriter and legal advisers, I reviewed and refined the policy terms to better align with the commercial model and customer journey. This ensured the product design, risk approach, and operational processes were consistent end-to-end, reducing ambiguity for both customers and the business.

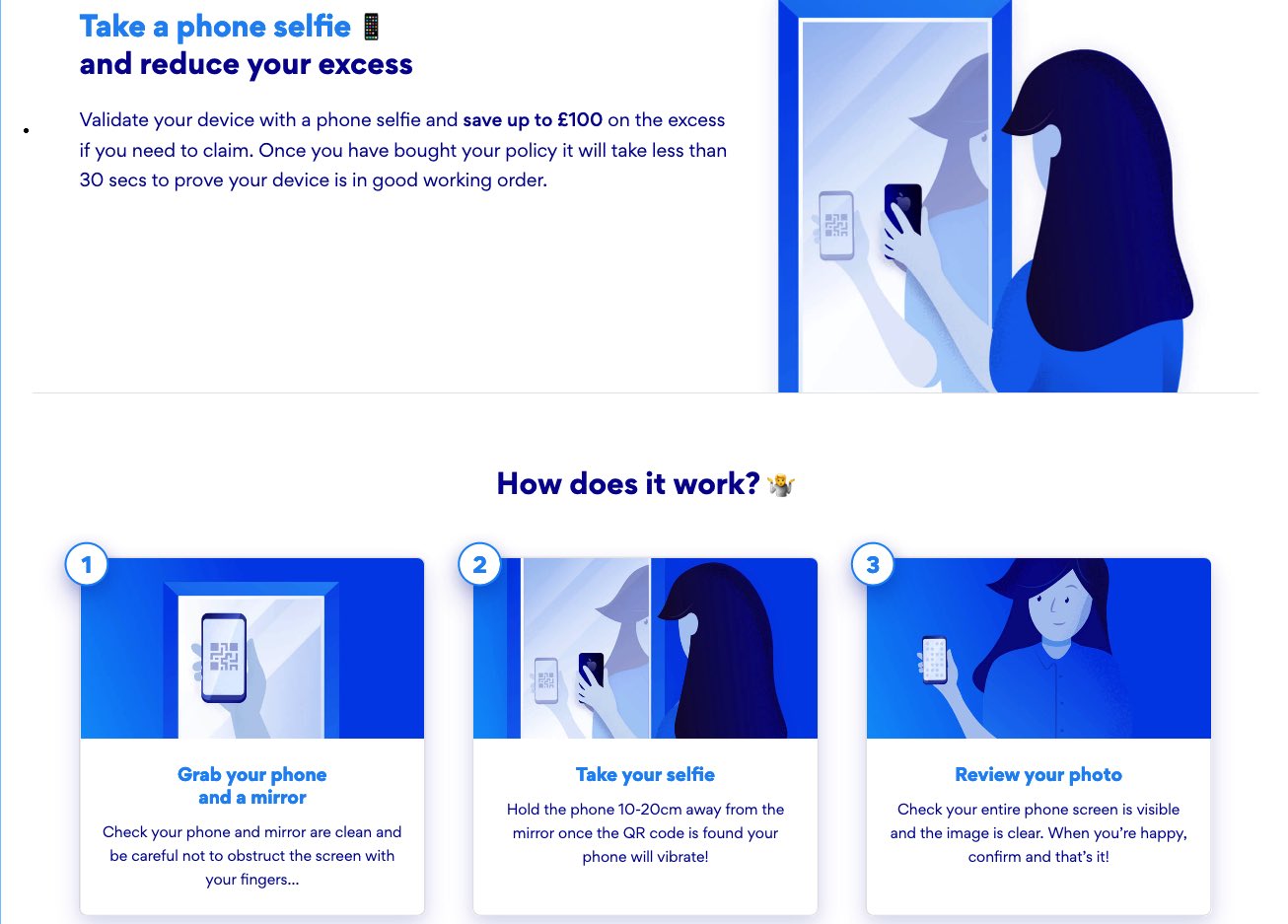

pic-sure: One major issue we identified was a high number of claims being raised almost immediately after purchase. Unlike many insurers, we wanted customers to be covered from day one. Initially we explored screen-tracing, which proved ineffective. I then proposed a model where the policy launched with a higher excess that would be significantly reduced once the customer submitted verified photos of their device. Working closely with the iOS developer, we designed flows and safeguards to identify and prevent fraud cases while keeping the user journey simple. I implemented the backend review and risk logic, with the iOS developer leading the client-side implementation. The longer-term plan was to automate crack detection using machine learning once sufficient data existed, but I left the company before that phase was reached. The approach materially reduced fraud exposure and ultimately formed the basis of the patented “pic-sure” process.

Architecture & Infrastructure: I designed the backend architecture and AWS infrastructure to support quoting, purchasing, policy administration, billing, renewals, referrals, and claims handling. This included third-party integrations for payments, KYC/AML, fraud screening, and device checks, as well as building the internal admin tools used by operations and customer support.

Regulation & Auditability: Working with the underwriter and compliance teams, I implemented the data flows, logging, and reporting needed to operate under an MGA model, ensuring the platform could support audits, bordereaux reporting, and regulatory oversight.

Results

so-sure grew from an early-stage startup to a business generating approximately £750k ARR by the time I left the company. In 2024, so-sure was acquired by Open Insurance Services.

pic-sure reduced claims by 50%, and we were granted a patent for the process.

The technical platform, experimentation capability, and fraud controls I implemented formed the backbone of the business through its growth phase and were a key part of the value ultimately acquired by Open Insurance Services.

I left so-sure prior to the acquisition after several intense years building and scaling the platform, stepping back for health and wellbeing reasons.